Bank of Baroda, Mudra Loan

Page Contents

- 1 Bank of Baroda Mudra Loan.

- 2 Categorization of Bank of Baroda Mudra Loans

- 3 ✔Where can apply for a BOB mudra loan?

- 4 ✔Who can apply for an SME mudra loan?

- 5 ✔What is the interest rate of the BOB PMMY Mudra loan?

- 6 ✔ Any guarantee require for a mudra loan?

- 7 ✔Is there any subsidy in BOB Mudra Loan?

- 8 ✔ Can we apply Bank of Baroda online e-mudra loan?

- 9 ✔ Is there any charges required for the Bank of Baroda Mudra loan

Bank of Baroda Mudra Loan.

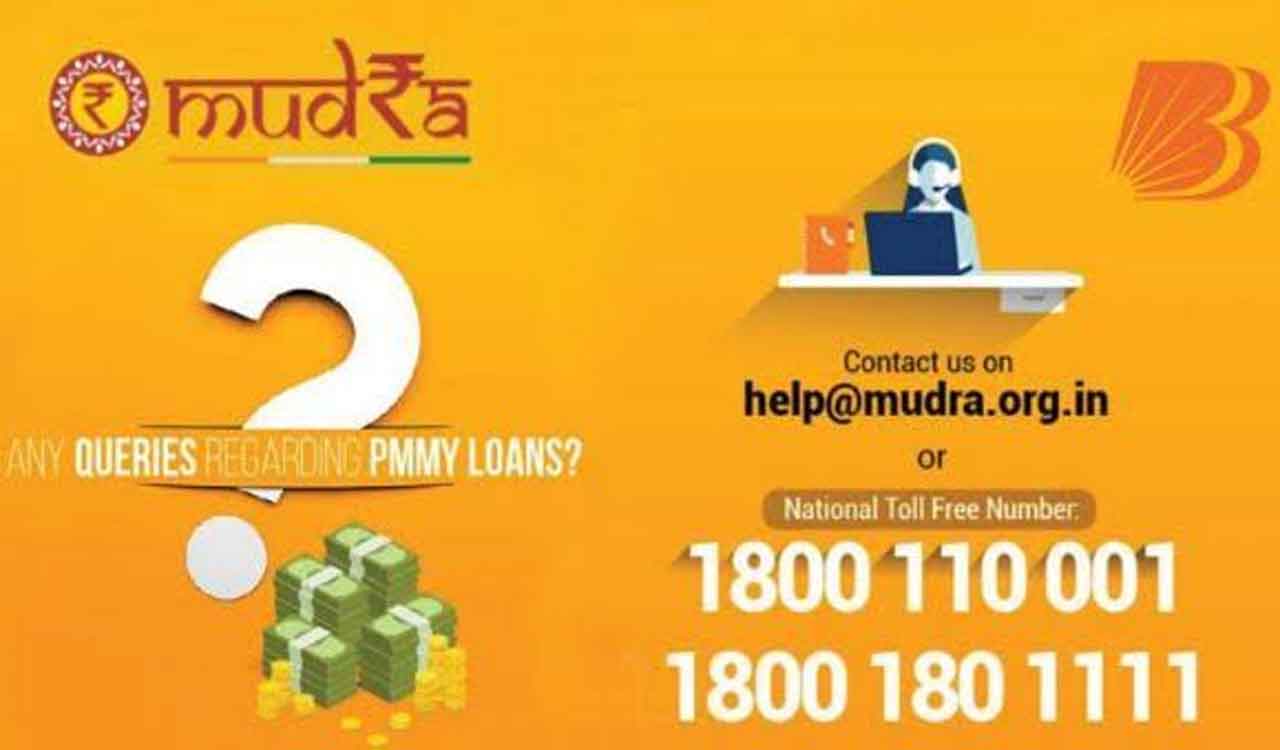

Bank of Baroda (BOB) PRADHAN MANTRI MUDRA YOJANA (PMMY), a flagship scheme of the government of India, changed into released on 8th April 2015 by using the Hon’ble Prime Minister to “fund the unfunded” by bringing such organizations to the formal financial device and increasing inexpensive credit score to them.

Credit facilities

Any form of Fund based or Non-Fund based total facility.

No minimum amount under the mudra bank loan scheme. The maximum amount is – Rs.10.00 Lacs. Under Mudra Bank.

Categorization of Bank of Baroda Mudra Loans

SHISHU: Loans sanctioned below the scheme up to Rs.50000

KISHORE: Loans sanctioned under the scheme from Rs.50001 to Rs.5.00 Lacs

TARUN: Loans sanctioned beneath the scheme from Rs.5,00,001 to Rs.10.00 Lacs

Security Deposit Under Mudra Bank Scheme.

property created out of the bank’s finance.

No collateral security.

Eligibility required with the aid of the Bank of Baroda

All “Nonfarm businesses”

underneath “Microenterprises” and “Small establishments” segments

engaged in “profits producing activities”

engaged in “production, trading and offerings“ and

whose “credit score wishes are up to Rs.10.00 lacs”

Now allied agriculture activities have also been protected underneath the PMMY scheme w.e.f. 01.04.2016.

Price of the financial institution of Baroda for Mudra mortgage.

Limits Micro enterprises Small organizations

as much as Rs.50000/- MCLR+SP (MCLR+SP)+0.50%

Above Rs.50000/- to Rs.2.00 lacs (MCLR+SP)+0.50% (MCLR+SP)+zero.70%

Above Rs.2.00 lacs to Rs.10.00 lacs (MCLR+SP)+0.70% (MCLR+SP)+zero.eighty-five %

Processing charges: Nil

Apart from that Bank of Baroda has started a new scheme which is the PM SVANidhi loan. It is available for all street vendors & it is collateral free now. The Ministry of Urban Development is taking care of that scheme.

If you are interested to get an instant PM SVAnidhi loan, you can apply it online via our website. We will update & guide you about the process, policy and procedures.

This scheme has been launched for street vendors like Chaiwala, Feriwala, Sabji Wala & all kinds of street vendors. Please do not pay anything to get this loan. Its processing fees are nil but the interest rate is around 7%. The tenure of SVAnidhi is 1 year.

If you are facing any issues with the Bank of Baroda Mudra loan or SVAnidhi loan or e-mudra loan, please write back to us. We will forward your grievances to the concerned authorities.

Digital Mudra Loan By BOB – Principle Approval In 30Min

Bank of Baroda digital e₹ app, click here to download.